Cyclone Gabrielle and the Christchurch and Kaikoura earthquakes have helped remind us all of the importance of insurance, but have also emphasized the importance of quality insurance advice.

Added Valuation has developed strong connections in the insurance industry which enables us to keep well abreast of insurance valuation requirements, in what is a dynamic period of industry change. Added Valuation produces insurance certificates for all types of commercial property including office, retail, industrial and special purpose commercial property. Our reports are favoured by insurance brokers and property owners because of the detailed investigations our Registered Valuer undertakes and the quality reports we provide.

Property owners normally insure their property against damage from earthquake, fire and other disasters because it is prudent risk management. But for leased or mortgaged property it is normally a contractual requirement to hold adequate reinstatement insurance cover. Obtaining an insurance valuation can help lower your insurance premium cost, and for leased property the cost of obtaining an insurance valuation can normally be passed to the tenant.

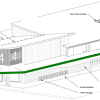

A property insurance value differs substantially from a market value in that the values being calculated are mainly concerned with the replacement of the asset in the event of a disaster, and does not concern itself with the land value.

Construction cost inflation can fluctuate significantly, with inflation rates of around 15% in recent years to near zero last decade. Construction inflation continues to be a significant risk, with the impacts of Cyclone Gabrielle influence supply and materials. Unfortunately costs don’t change evenly. Recently demolition cost inflation has been significantly higher than the general construction rate, as dumping fees have skyrocketed.